Bond funds: Take a close look at your 401k

The Warning E-Mail I Sent To My Family During the Covid-19 Outbreak

I'm writing this to everyone because I'm very worried that we are at a market top with respect to bonds. Bonds will never again be as expensive again as they are today. As you may or may not know, bond prices rise as interest rates fall. And bond prices fall when interest rates rise. It is an inverse relationship. I've attached a chart showing the 10-year treasury yield (the interest rate) over my lifetime. As you can see it has steadily fallen to zero. It literally cannot fall any further unless rates go negative. That means you'd have to pay the government to have them hold your money. Unless you think that's a realistic scenario for the United States you shouldn't own any bonds right now. I'm sure some of you are very heavily invested in bonds, because the typical advice is to buy bonds when nearing retirement. That has always been good advice because bonds are usually less volatile than stocks and pay a steady interest. But now things have fundamentally changed.

This constant downward fall in interest rates over the past decades is what has allowed bond funds to perform well over the years. But that is going to be impossible going forward, because the interest rate cannot fall any further. And beginning in mid-August, the treasury yield bottomed out and is now rising again. If you have any mutual fund which purchases long-term bonds (20/30 years) of any kind (treasuries, emerging markets, corporate bonds), that's the worst case scenario. Those funds will lose around 15-20% of their value for every 1% increase in interest rates. A 2-3% increase in the interest rate will cut their value in half. Rates have already gone from 0.60% to 0.87% just in the month of October. That's a 27% increase in the interest rate in just 1 month. I've attached a chart where you can see that the interest rate has begun its move upward after bottoming out after the pandemic hit in Feb/Mar.

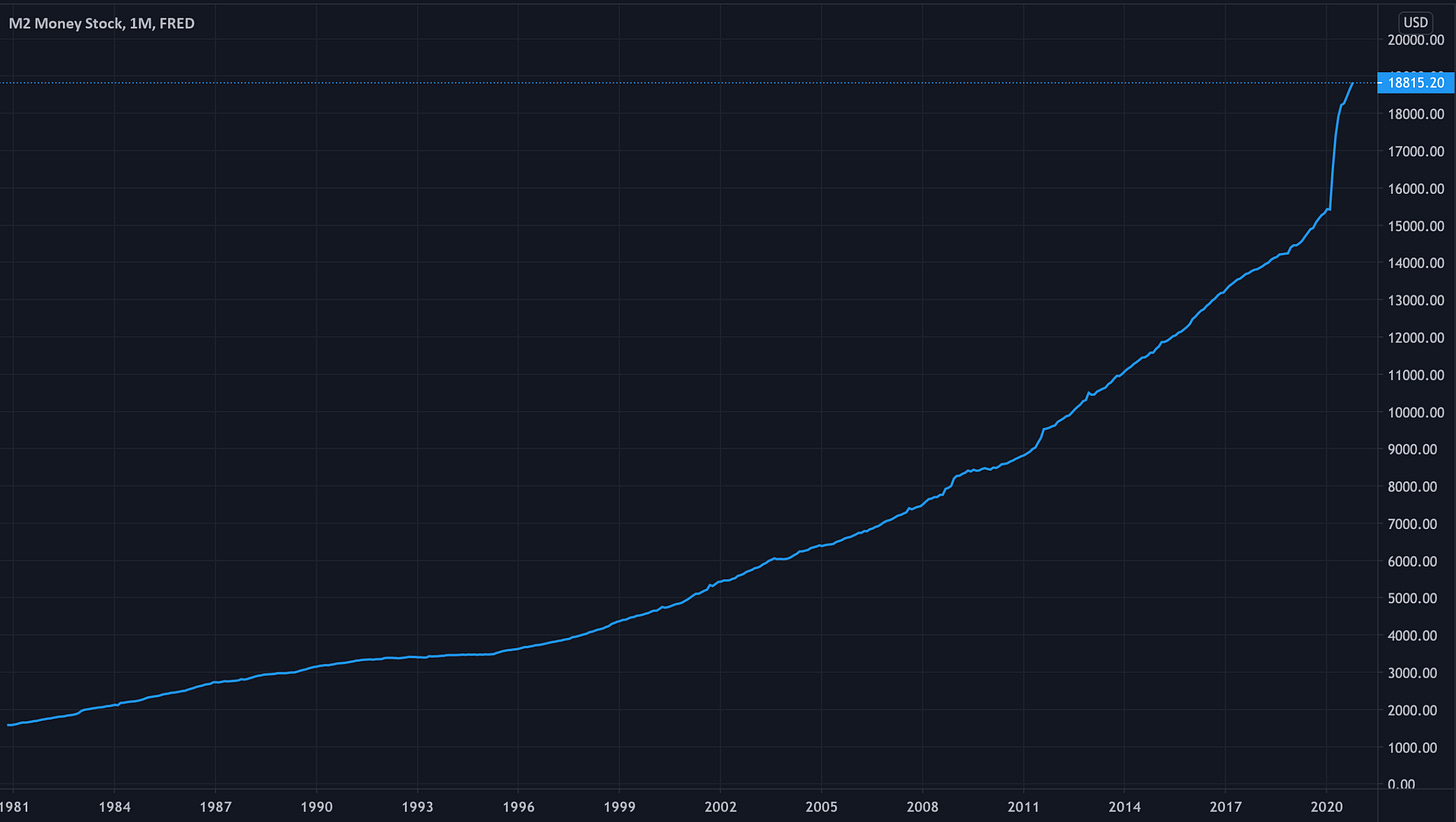

I've also attached a graphic of M2, (the money supply), over my lifetime. When you see the amount of money that the Federal Reserve has printed due to COVID19 and the deficit that the country is running, I believe it will be impossible to think that inflation will stay as low in the future as it has been in the past. And if inflation begins to rise, interest rates will have to rise to combat that if the Federal Reserve plans on controlling inflation.

That's why I feel there's no reason to own any bond fund at this time, not until interest rates have risen again back to a somewhat normal level. I think a lot of baby boomers are going to see a large portion of their retirement wiped out by an armageddon of falling bond prices. Please speak to whoever helps you plan your finances/retirement and take a hard look if it makes sense for you to own any bonds in the current interest rate environment.

Stay safe!