Why I Park My Cash in BOXX

When you owe taxes in two countries, efficiency matters. This ETF quietly converts interest into long-term capital gains.

What do you do when your savings account gets double-taxed?

Short-term interest sounds great — until Argentina and the U.S. both want a bite.

That’s my situation. Two tax systems. No tax treaty. And no clean way to hold cash without watching the yield get carved up before I ever spend it. Treasury bills? Taxed as ordinary income. Money markets? Same story. I could earn 5% on paper and walk away with 2% in practice — if I was lucky.

So I started digging.

I wasn’t looking for a trade. I was looking for a tool — something that could hold capital safely, keep it liquid, and stop bleeding return to annual taxes. Something that worked with an options-heavy strategy. Something built for taxable accounts. Something efficient.

I found BOXX.

This isn’t a traditional ETF. It doesn’t hold bonds. It doesn’t pay dividends. It doesn’t even look like it’s doing much. But under the hood, it’s running a strategy that mimics T-bill returns using options — and converts what would normally be taxed as interest into long-term capital gains.

It’s not magic. It’s structure.

And for investors who care about taxes — or who, like me, have no choice but to care — it’s a rare kind of breakthrough: a cash substitute that doesn’t punish you for waiting.

What follows is how it works, why it matters, and where it fits in a strategy like ours.

Why BOXX Matters in My Situation

I live in the uncomfortable overlap of two tax systems.

As a U.S. citizen, the IRS wants its cut. Every year. On every dollar. No matter where I live. And as a tax resident of Argentina — a country that treats even modest interest income like it's windfall profit — I get taxed again. No treaty. No credits. Just two governments, one pile of savings, and no clean escape hatch.

So when short-term rates surged in 2023 and 2024, most investors got excited. Suddenly cash was yielding 5%. High-yield savings accounts were back. Treasury bills finally paid more than lint. But for me, every basis point of interest was a liability. That 5%? Closer to 2.5% after Argentina took a slice. Lower still after U.S. taxes kicked in. The “risk-free” rate wasn’t risk-free at all — it came with guaranteed erosion.

Naturally, I started looking for a workaround.

And here’s what clicked: BOXX.

BOXX isn’t trying to pay you interest. It’s trying to look like interest, while not being taxed like interest. That distinction, subtle for most, changes everything for people like me. Because capital gains — even short-term ones — don’t trigger Argentine ordinary income tax rates. And in the U.S., BOXX’s structure means I can eventually claim long-term capital gain treatment — often at half the rate I’d otherwise pay on interest.

That makes it one of the only places I can park dollars without getting penalized twice.

There’s no form I have to file. No workaround to explain. Just an ETF that tracks Treasury returns — but via options trades — and keeps its yield hidden inside the share price. From the outside, it looks like a slightly sleepy fund with no dividends. From the inside, it’s quietly building return — and deferring tax — in exactly the way I need.

It’s not a loophole. It’s not aggressive. It’s just... efficient.

And for once, I get to be on the right side of that.

What BOXX Actually Does

BOXX isn’t a bond fund. It doesn’t hold cash. And it doesn’t pay interest.

Instead, it does something a little weirder — and a lot smarter.

BOXX makes money by lending cash into the options market through a structure called a box spread. If you’re already familiar, great. If not, don’t worry — you don’t need to master the mechanics. Here’s the simple version:

Imagine you could give someone $950 today and get exactly $1,000 back one year from now — guaranteed, no matter what the market does. That’s the entire premise of a box spread. It’s a synthetic loan. The $50 difference is your “interest.” Except it’s not taxed as interest. It’s the byproduct of a perfectly hedged options position.

And BOXX runs these trades over and over — not yearly, but every 1–3 months — using deep liquid S&P 500 index options. It’s not betting on direction. It’s not taking market risk. It’s just using the options market as a place to park cash with a defined payoff at expiration.

Importantly, BOXX does all this inside an ETF shell. So as a shareholder, you never see the trades. You don’t have to manage anything. You’re just holding a share of a fund that gradually increases in value, mimicking the return of short-term Treasuries — without ever touching a bond.

That’s the magic.

There are no monthly interest payments. No dividend declarations. No statements saying “you earned X in income.” Instead, your account value simply ticks up. The growth is real — but it’s invisible to the taxman until you sell.

And because the trades themselves are in index options (which qualify under Section 1256), the IRS treats the gains as 60% long-term and 40% short-term, no matter how short the actual holding period inside the fund. So BOXX wraps two tax advantages into one structure:

No taxable events while you hold.

Favorable tax treatment when you eventually sell.

For someone used to dodging landmines with every dividend, it feels bizarrely peaceful.

The Tax Alchemy — Why It Works (for Now)

Let’s start with the obvious: most cash yields are taxed poorly. Treasury bills? Taxed as ordinary income. Money market funds? Ordinary income. High-yield savings? Same story. If you’re in the top U.S. bracket, you’re losing up to 37% of that yield before it even hits your account.

That’s already bad.

Now layer in a second tax system — one that also treats interest as regular income — and you start to see my problem. Every dollar of yield gets chewed up twice. The nominal return looks great. The after-tax return barely beats a mattress.

BOXX changes all that.

Instead of paying out interest, BOXX retains all returns inside the fund. The underlying options trades settle as gains, not income. So from a tax perspective, nothing happens until you sell your shares. And when you do — as long as you’ve held for over a year — the growth is taxed as long-term capital gains, maxing out at 20% federally.

But the real kicker? The deferral.

You’re not paying 20% every year. You’re paying it once — when you exit. That means your return compounds untouched. You’re earning a “pre-tax” yield on your post-tax dollars, year after year, with no leakage. That alone is a form of alpha.

Let’s make it concrete:

If you hold SGOV or a money market at 5%, and pay 37% tax, your take-home is 3.15%.

If you hold BOXX and earn 5% taxed at 20% (eventually), your take-home is 4%.

Add in tax deferral, and the effective rate jumps to something like 4.07%–4.15%, depending on how long you hold.

That spread — almost a full percentage point — is enormous in cash terms. Especially when it applies to hundreds of thousands in reserve capital. Or, in my case, to capital that would otherwise get taxed twice.

But there’s a catch: you have to hold.

If you sell BOXX after 3 or 6 months, the gains are taxed at short-term rates. You still get deferral, but you lose the lower tax bracket. So the whole trick here depends on discipline. Park your funds. Leave them alone for a year. Then reap the rewards.

And that’s what makes BOXX so clever. It doesn’t try to trick the tax code. It just rearranges the pieces — converting taxed-every-year income into taxed-once gains. And because it’s wrapped in an ETF structure, it avoids the usual wash sale rules, dividend timing issues, and annual paperwork.

For high earners, the math is compelling.

For dual-taxed investors like me, it’s almost too good to be true.

(Which is why, in the next section, we’ll talk about whether it stays true.)

Institutional Leverage for Retail Use

If you’ve ever tried to build a box spread at a retail broker, you know the real risk isn’t the trade — it’s the platform.

The structure itself is straightforward. You want to lock in a risk-free return by buying one vertical and selling another — a synthetic loan. But most retail platforms won’t let you do that in a single trade. They don’t offer a “box spread” ticket. So you have to leg in.

And that’s where the risk creeps in.

You enter the first vertical. Then you go to build the second. Market moves. Liquidity thins. Or the quotes just don’t match up. Now you’re exposed — briefly, but materially — to directional risk you didn’t sign up for.

And even if the trade goes through, margin treatment is often a disaster unless you have portfolio margin — and most don’t. Let’s be honest: the last thing your broker wants is for you to borrow money via box spreads — and avoid their juicy 13% margin interest.

That’s how they make their money. BOXX… short-circuits that.

Because BOXX isn’t borrowing. It’s lending. At scale. Through institutional pipes. Fully collateralized and cleared via the OCC. No legging in. No mismatched quotes. No margin red flags. Just a wrapped, managed fund that does the hard part for you.

For a tiny fee — 0.19% — you get execution, scale, tax handling, and broker anonymity.

BOXX gives you the same payoff as a broker box spread, but without the platform gymnastics.

Performance vs. the Alternatives

Here’s the thing: if BOXX only matched T-bill returns, that would be enough.

Because you’re not buying BOXX for higher gross yield. You’re buying it for the after-tax outcome — the net result, not the headline number. But even if we ignore taxes for a second, the truth is: BOXX actually holds its own.

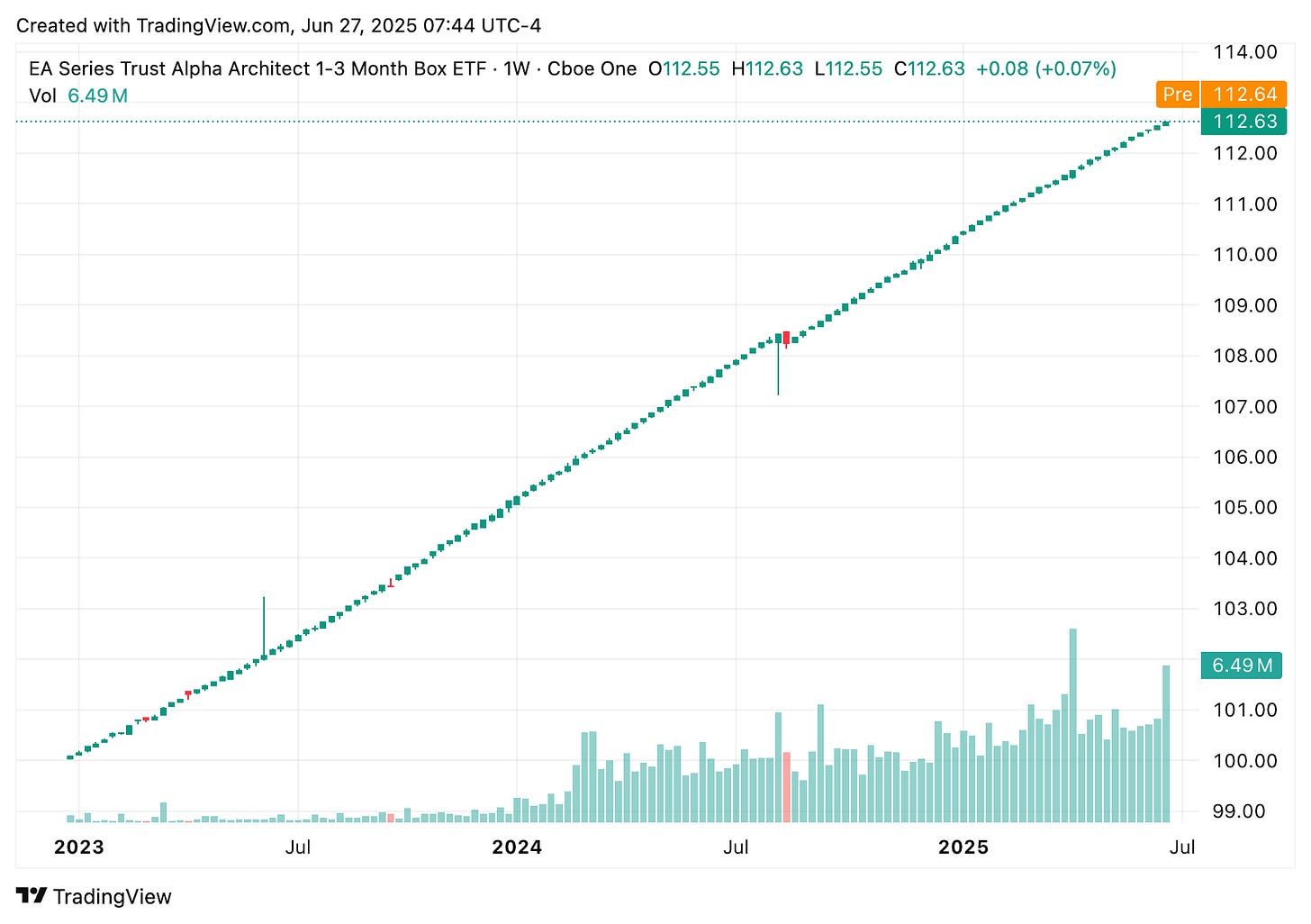

In 2023, BOXX returned +5.04%. That’s nearly identical to SGOV’s +5.12% and slightly above BIL’s +4.94%. These are rounding-error differences — the kind you can chalk up to fee drift or small timing mismatches. More importantly, BOXX achieved that without taking meaningful extra risk.

The volatility? Tiny. The drawdowns? Almost nonexistent.

Over the past year, BOXX’s standard deviation hovered around 0.09%, while SGOV’s was about 0.05%. The difference is microscopic — especially when we’re talking about an ETF that holds no bonds, takes no market exposure, and is built entirely on options. BOXX’s NAV just… ticks upward. Slowly. Predictably. Like a cash alternative should.

And here’s where things get interesting: BOXX doesn’t pay out dividends. It doesn’t send you a monthly interest payment. The return is retained in the share price. That’s not a bug — that’s the point. It defers taxation. It avoids triggering events. It lets the compounding do the work inside the wrapper.

So yes, if you’re someone who needs monthly income, BOXX might look quiet or even underwhelming. There’s no dopamine drip. But if you care about keeping what you earn — especially in a taxable account — BOXX has delivered exactly what it’s supposed to.

It tracks. It compounds. It doesn’t create problems come April.

The tradeoff is this: you give up a little transparency and immediacy (no cash flow), in exchange for better tax treatment, more control, and a cleaner balance sheet. Instead of a dozen interest line items, you get one capital gain when you exit — on your terms, at your timing, ideally after 12 months.

Which brings us back to the core idea: BOXX isn’t about squeezing an extra basis point. It’s about avoiding leakage. And when you compare its execution to traditional T-bill ETFs or money markets, the evidence is clear:

You get the same ride. But you keep more of it.

The Risks Nobody Should Ignore

Let’s not kid ourselves. BOXX is clever — maybe a little too clever.

And that’s the risk.

Not volatility. Not liquidity. Not even the counterparty structure. The real threat is that one morning, the IRS wakes up, looks at this fund, and says: “Wait, you’re telling me this thing is effectively paying interest… but taxing it like a capital gain?”

Because yeah — that’s exactly what it’s doing. Legally. Transparently. But arguably pushing right up against the line.

BOXX works today because it wraps box spreads inside an ETF structure. The spreads themselves settle as gains (not income) under Section 1256. And the ETF avoids taxable distributions through in-kind redemptions. It’s a perfectly legal structure — for now.

But tax law isn’t static. And the IRS doesn’t love when everyday investors start using tricks that used to be reserved for hedge funds.

A former Treasury official called BOXX “a tax gimmick in a box.” That’s not the kind of quote you want to see. And there’s precedent for rule changes. Congress has already closed other loopholes involving derivatives, structured notes, and mutual fund timing schemes. They don’t always act fast — but when they do, they rarely act gently.

If the IRS or Congress decides BOXX is too aggressive, a few things could happen:

They could reclassify its gains as ordinary income, retroactively or prospectively.

They could strip Section 1256 treatment from box spreads held in ETFs.

They could require funds that behave like fixed-income to distribute income annually.

Any of those would kill the edge. The ETF might still function. It might even still return 5%. But the whole point — deferring tax and converting interest into long-term gains — would vanish overnight.

Would they act retroactively? Probably not. But we don’t know. And that uncertainty — that policy risk — is the single biggest reason not to go all-in.

Because you’re not just betting on box spreads working. You’re betting on the tax code staying still. You need to determine if that is an acceptable risk for your scenario.

Now, let’s be clear: I’m not saying BOXX is a house of cards. It’s well-designed. Fully collateralized. Cleared through the OCC. There’s no leverage. No hidden derivatives. Just a smart structure that uses the rules as written.

But the more popular it gets — and with $6+ billion under management, it’s already on radar — the more likely someone starts asking uncomfortable questions. So I hold BOXX. But I also know there is a possibility that it could get nerfed. Because in the end, this isn’t about credit risk or market risk. It’s about political risk.

Where This Fits in My Strategy

In my Collateral Compounding strategy, idle cash is dead weight.

I’m constantly deploying buying power: selling puts, rolling exits, layering into positions. Every dollar that isn't working drags down the overall return. But being 100% allocated is a mistake too. Because when the market offers you gift, you need the ability to act.

That's why real liquidity matters.

Cash is the reload button. It lets you press advantage. It keeps you from becoming a forced seller. And it gives you control over timing — especially when markets don’t.

BOXX is my solution for that in-between zone. It gives me three things I care deeply about:

1. A place to park excess funds

Capital that isn’t allocated right now but might be tomorrow needs a home that earns something — without creating tax friction. BOXX earns T-bill-like yields while deferring taxes, which keeps return compounding until we actually need it.2. After-tax efficiency

Most short-term cash parking solutions leak value to taxes. BOXX doesn’t. It turns “waiting” into “quiet compounding” — and keeps more of the gain in our pocket when we finally realize it.3. Firepower on standby

Whether it’s covering a rare assignment, doubling into a high-conviction name, or posting collateral for new trades, BOXX lets us stay liquid without sacrificing yield. It’s a sleeping asset that wakes up instantly when we need it.

And maybe there’s a little poetic justice here.

As options sellers, we’ve built our strategy on collecting premium. BOXX does the opposite — it lends liquidity back to the options market through synthetic interest. It’s a round-trip that feels oddly fair.

We take from the options market when it’s paying us. And now, when we’re not deploying, we lend to it. On terms we like.

Who BOXX Is For — And Who It Isn’t

BOXX isn’t for everyone. But for the right kind of investor, it might be the best cash tool available.

If you’re holding short-term reserves in a taxable account, BOXX gives you a rare edge: T-bill-like yield, deferred taxation, and the potential to convert that yield into long-term capital gains. It’s quiet. It’s passive. And it avoids the annual haircut that most cash alternatives take for granted.

But the benefit only matters if you’re actually paying tax.

So let’s be honest about who this isn’t for:

If you hold cash in an IRA or 401(k): Skip it. You’re already tax-deferred. BOXX just adds complexity and fees for no advantage.

If your income puts you in the 0%, 10%, or 12% bracket: You’re not paying much (if anything) on interest anyway. The whole “conversion” benefit becomes moot.

If you need access in under a year: BOXX works best when held for 12+ months. Sell early and you lose the long-term gain treatment — which is the main point.

But if you’re in a high tax bracket — or if you, like me, get taxed twice because of where you live — BOXX isn’t just a nice idea. It’s a real solution.

And if you’re a non-U.S. investor who is investing in U.S. markets? It’s a gift. The U.S. doesn’t tax capital gains for foreign investors. So by using BOXX, you can now earn short-term U.S. interest — synthetically — with zero U.S. tax liability. That’s not a loophole. That’s just how the rules work. And it’s hard to beat.

So no, BOXX won’t replace your core equity exposure. And it’s not meant to juice returns through some wild options strategy.

It’s a tool. A place to park dollars safely — and keep more of what they earn.

For the right investor, that’s more than enough.